How a Small Apartment Building Made Me $40,000 Per Year

I'm going to use my first deal as an example to demonstrate to you WITH REAL NUMBERS how powerful apartment building investing can be.

I use this particular case study because it's the kind of FIRST deal that YOU can do ANYWHERE in the country. Even though this is a small deal (12 units), it still added $40K to my net worth EVERY year for FIVE years.

And I didn't use any of my own money.

Let me show you exactly how this deal added $40K to my net worth every year for five years, and I hope in the process you'll see that you, too, can do a deal like this.

Here's how I bought the property:

- Source: MLS (listed by residential broker)

- Purchase price: $530,000

- Renovations: $54,000 (or $4,500 per unit) - it needed a lot of renovation.

- Cash needed to close: $227,000 raised from 5 investors in return for a 50/50 split.

- Projected Returns: 15% per year for the investors

- Acquisition Fee: $15,900 payable to me.

After closing on the property, I renovated the exterior of the building and many of the units. This allowed me to slowly raise the rents, fill the vacancies, and evict non-paying tenants.

This took a REALLY LONG TIME ... like 3 years.

After 5 years (as I write this), I have it under contract to sell for $850,000. Overall, this building made me a profit of $198,434 in 5 years - or about $40,000 per year.

How is it possible to make $40K per year with such a small building and with none of my own money in the deal?

Let me break it down for you by profit center:

- Cash flow over 5 years was a total of $130,545 (after all expenses and my fees). That's about $181 per unit per month. Cash flow was tight the first couple of years, but it picked up in the last 3 years (as we raised the average rent from $595 to $825).

- The Appreciation was $146,500 after closing and sales costs, and NOT including loan repayment and sponsor fees.

- Loan Reduction: the loan principal was reduced by $48,265 in five years.

The total profit from these 3 profit centers was $325,310. Dince I have a 50% share, my portion of those profits are $162,655.

"What about the $15,900 acquisition fees that I pay myself at closing?"

Oh, I almost forgot ...

I paid myself $15,900 at closing when I bought the building. I also charged an asset management fee of $2,275 per year (1% of money raised) and a 1% disposition fee of $8,500 when we sold the building.

All told, my sponsor fees totaled $35,779, putting MY net profit at $198,434 - about $40,000 per year.

It wasn't rocket science. And you can do this too.

What did I really do with this property?

I found a property with some problems that I felt I could fix in 3-5 years. I renovated the property, increased the rents, and reduced the vacancy. It wasn't rocket science. It required some knowledge, taking action, and hiring the right property management company to execute on the plan.

If you feel a bit overwhelmed by the numbers, just take a deep breath.

And make sure you don't miss the main point here:

Apartment buildings (even smaller ones) are the single best way to create passive income and long-term wealth so you can do whatever you want in 3-5 years.

OK, I hear you saying "That's great, Michael, but if I'm doing the math right, each unit cash flowed $181 per month and my share is half that. That's only $1,087 in total cash flow per month.

"How in the world is THAT going to let me retire in 3-5 years ?!?"

That's a good point. By itself, it won't.

But stick with me for just a bit longer and you'll see how it will.

Let me paint you a picture of how this first deal leads to your ultimate goal of retiring in 3-5 years.

Let's first understand how the 4 profit centers break down by unit and by month:

While each unit produces $91 per month in passive income for you, it also produces $50 in fees and $135 of profit (appreciation + loan repayment) per unit per month.

That means each unit is adding $276 to your net worth every month.

So far so good, right?

Now remember, this is only your first deal. And I can tell you from interviewing dozens of new and experienced multifamily investors. What they have proven time and again is this:

It's All About Your First Deal.

Once you do your first deal, everything else happens much easier (and almost automatically).

Take Jay Boyle from New Jersey. It took him TWO YEARS to do his first duplex deal.

Really?

Yup, you heard right ... two years.

But then an interesting thing happened.

By the time he closed on that duplex, he already had his second deal under contract: a 36-unit deal in Arizona (near where his parents live).

Or check out Bruce in Texas:

he did his first deal, a huge 134 unit deal, and it took him a whole year to get it under contract and several months to close. It was hard. He had to raise a ton of money, and he had all kinds of issues during the closing process.

But you know what? Within two weeks of closing that deal, he had a 110-unit deal in Amarillo TX under contract and closed on it a couple of months later.

Here's what I observe over and over again with people I interview on my podcasts and other successful real estate investors, and here's their advice for new investors:

"Focus on your FIRST deal".

Once you close that first deal, you will close a 2nd and 3rd in rapid succession and "suddenly" control 100 units. All within 3-5 years.

Here's Why your First Deal is So Important

When you do your first deal, even if it's only a 12-unit deal, here's what you have you didn't have before when you got started:

- Track record and credibility;

- Investors (who invest more with you and refer you to other investors);

- Brokers feeding you (off-market) deals; and

- Team on the ground, ready to go.

Most likely, when you close on that first deal, you have several deals in the pipeline or under contract. And I can guarantee you that that 2nd deal is bigger than the first. If you start with a 12-unit deal, then your second deal is going to be 20-50 units. And the 3rd deal is going be even bigger.

I want you to remember ONE THING from reading this:

Focus on your FIRST deal (Nothing else matters).

Forget everything else for the moment. Do whatever it takes to focus on that one deal. Once you do that one deal, everything else will get much easier and you will get your second and third shortly thereafter.

Let me show you exactly how that small 12-unit deal from earlier will get you to from where you are right now to retirement in 3-5 years.

If you remember, that 12-unit building generated $91 per unit in passive income for you every single month.

What's YOUR Rat Race Number? (And Why It's Important to Know)

Let me ask you a question: have you thought about your "rat race number"? The Rat Race Number is the amount of money you would need each month to cover to quit your job. Specifically, it's the amount of passive income you would need to cover your most basic living expenses.

If you could have your real estate investments produce THAT much passive income each month, you could quit your job, retire, or do whatever you wanted.

That's your Rat Race Number, and THAT'S what you're seeking with real estate investing, am I right?

How many units would you need to control to retire or quit your job?

Continuing our example from earlier, let's assume your Rat Race Number is $5,000 per month in passive income.

Assuming each unit produces $91 in monthly income, that means you would need to control 55 units to quit your job.

Here is how it's likely to play out once you do your first 12-unit deal:

- Once you close on that deal, you'll probably already have your second deal under contract, and it'll probably be between 20 and 30 units (based on my experience).

- And you'll probably do your 3rd deal several months after that, and that deal will be somewhere between 30 and 60 units.

Let's assume your first deal is a 12-unit, then a 20-unit and then a 30-unit deal. Here is the math:

By this point you control 62 units (all with other people's money BTW), and your passive income is $5,621 per month.

But equally important is that your NET WORTH increases by $17,087 per month if you consider your fees, appreciation and amortization.

Staggering.

And it all started with that one small deal.

Can you see it?

I hope you can.

But in the off-chance you can't see yourself doing a 12-unit deal or you want results faster, then I have a Plan B for you, which is this:

Want Results in 90 Days? Then Buy a Duplex to Get Into the Game

That's right. You're going to do what Jay Boyle did: buy a duplex as your first deal.

Buying a duplex is MUCH easier and faster because:

- There's more of them and you're likely to find a good deal in your local market so you don't have to invest out of town;

- They cash flow better per unit than a larger multifamily building; and

- You need less cash, which means you might be able to do the deal without raising money, or you need to raise much less money.

In other words, it takes much less time and money to buy a duplex.

Let me share with you how a UPS driver bought two small 4-plexes and is ALMOST out of the rat race.

How a UPS Driver is ALMOST out of the Rat Race with Two Quads

Brooks Everline is a UPS driver during the day and decided that he didn't want to do that for the rest of his life, and was looking for a way out.

After exploring various options, he decided that multifamily investing would be the way to go, but with his limited resources, he knew he had to start small. So he decided to look for small apartment buildings.

He educated himself and then started to look for deals. He finally purchased a vacant quad in Hagerstown MD with a hard-money loan, fixed it up a little and filled it with tenants. The building cash-flowed $800 per month. He refinanced it to repay the lender.

Within 3 months, he closed on a second deal, a 5-unit building that now cash flows $1,000 per month.

His Rat Race Number?

$4,000.

He's about half way there.

And he's close to getting a 10-unit under contract.

Brooks is very confident that he'll be able to quit his job and become a full time investor within the next 12 months.

Do you see how important that first deal is?

Even if it's "only" a duplex or quad.

Focus on that FIRST deal. It changes everything.

OK, if you've stuck with me this far, that you can probably see that apartment building investing is in fact the best way to achieve your financial goals (and retire) in the next 3-5 years.

But you have a problem.

"Yes, Michael, I hear you, but I don't have the money, experience, or time!"

And because of this, you might conclude that apartment building investing works for SOME people but not YOU, and you dismiss it as a viable strategy.

And that's a shame.

Because as I will show you, they're all lies.

That's right - lies.

Don't think you can get started with apartment building investing because you don't have the money to invest?

Don't worry - I will teach you how to raise it from others. It's not hard if you follow my step-by-step system. You will then realize (like me and many others) that your ability to scale your business is only limited by your ability to raise money. What an incredible AHA moment!

Don't think you have the experience and worried people won't take you seriously?

Don't worry - I'll teach you techniques so that people won't know you're a newbie. With a little bit of knowledge (and scripts!), people will treat you like an experienced investor.

Not sure how to analyze deals and make offers?

Don't worry - within a month, you'll be a master at analyzing deals and you'll confidently make offers.

Don't think you have time? Or maybe you don't want to wait forever to get results?

Don't worry - you can do this with a full-time job. And I'll show you how to do your first deal in the NEXT 90 days.

I want to SHIFT your mind from what you THINK you know about apartment building investing to what is actually POSSIBLE.

I've found that when people they see the exact step-by-step BLUEPRINT to doing their first deal, they begin to visualize the process and to BELIEVE that they, too, can do their FIRST deal.

Why I Do What I Do

There's TWO reasons I'm writing to you today:

- I've experienced the transforming power of apartment buildings in myself and other financially-free people.

- I'm a teacher at heart, and I love teaching. Why keep a good thing to myself? I can't. That's why I want to help people achieve the same degree of financial freedom as I (and others) have. I know it works. It's worked for me, it's worked for others, and it can work for you too. I'm convinced of it.

I feel like I have the experience and people have told me that I have the ability to teach a "difficult thing" like apartment building investing to others in an easy-to-understand and actionable way.

My passion is helping you do your first deal. I feel like right now, that's my calling in life.

"I Figured it Out So You Don't Have To"

When I first got started with apartment building investing, I read books and attended (expensive) seminars but I still didn't really know how to efficiently analyze deals (which is necessary to make offers with confidence).

It took me 4 hours to analyze deals to answer the question "what is the most I can pay for this property and why?". It took so long and was so overwhelming that I almost gave up.

Today I can teach you how to do that in just 10 minutes. I now have the technique and tools to help you do that.

Even more importantly, none of the books and seminars taught me how to raise money. I had no idea how to find the investors, what to say to them, how to structure the deals. And I had no clue about SEC regulations!

Since then I've raised and deployed $1.6M for house flips, apartment buildings and even restaurants. I know how to raise money, and I can teach you how to do it, too.

Today I have the process of raising money down to a step-by-step system. If you follow what I teach, you'll not only raise all the money you need for your first deal, but you'll have it raised BEFORE you even put you first deal under contract.

I've wasted a bunch of time and money trying to figure it out so you don't have to. I've made a TON of mistakes, so you don't have to. I've figured out what works (and what doesn't) so you can achieve your goals faster. I've developed a system that has worked for me and for many others.

And now I am privileged to share that system with you.

The "Ultimate Guide to Buying Apartment Buildings" is the BEST system on the planet to help you quit the rate race in 3-5 years.

It teaches you everything you need to do your FIRST apartment building deal with a special focus on raising money.

- You'll get instant access to my proven step by step process of buying apt buildings with other people's money.

- You'll become a master at analyzing deals so that you're able to make more offers.

- Then your confidence and credibility will sky-rocket which means brokers will return your phone calls and investors will want to invest with you.

- And once that happens, you'll be able to do your very FIRST deal ...

- And when that happens, you'll do your 2nd and 3rd deal in rapid succession ... and then ...

- You'll be able to quit your job, retire, or do whatever you want to do.

That's my 3-5 year real estate retirement plan for you.

And it all starts with your FIRST deal.

That's my passion ... to help people like you do their first apartment building deal. I have the system and the tools to make you successful. What I teach works any where and any one can do it if you follow what I teach in my system.

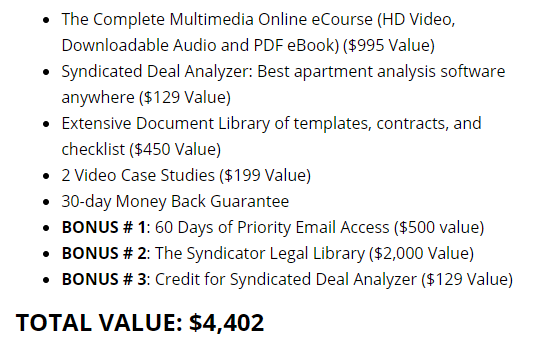

Comprehensive Online Course ($4,250 Value)

- Instant access to online course with 8 1/2 hours of HD video, downloadable audio and 185-page ebook.

- Access as many times as you like and in the format you prefer.

- Track your progress as you work through the course.

- Everything you need to do your FIRST apartment building deal with a special focus on raising money.

- It's like having me in your living room for one-on-one coaching for 8 1/2 hours. At my hourly coaching rate that would cost you $4,250.

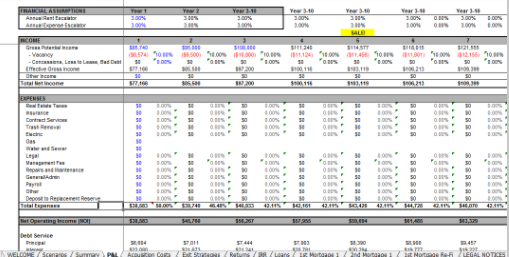

Syndicated Deal Analyzer ($129 Value)

- Includes the most popular apartment analysis tool on the planet, the "Syndicated Deal Analyzer".

- Learn my "10-Minute Offer" technique that lets you determine the most you can pay for a property in just 10 minutes.

- Create detailed 10-year projections, how to structure the deal with you investors, and how much you can pay yourself.

- Become a Deal Analysis MASTER so that you can make offers confidently.

- Retails for $129 if purchased separately.

Document Library ($1,500 Value)

- Contains sample contracts, templates, credibility kit, check lists and other documents referenced throughout the course.

- Raising Money: Credibility kit, sample bio, email template, sample deal package.

- Syndication: Sample PPM and Subscription, two Operating Agreement Templates

- Making Offers: letter of intent, purchase contract, sample addenda.

- Due Diligence: Weekly check-list, Letter to Seller to Request Due Diligence Documents, sample property inspection report.

- Financing: Personal financial statement template, term sheet comparison worksheet, sample term sheet.

- Much more, and updated constantly!

Video Case Studies ($500 Value)

This bonus is designed to make you a Deal Analysis Master! Each of the 6+ video case studies is about 45 minutes long, and I analyze a deal from start to finish, including several "what-if" scenarios.

Watch me do it, then download the marketing package and do it yourself.

You'll be a Deal Analysis Master in a week, and that in turn will let you make more offers more confidently.

This $500 package is normally only available to my Mastermind students but they're yours - FOR FREE - if you purchase my system before this Sunday at midnight EST.

Try out the Ultimate Guide System for 30 days ...

100% RISK FREE.

I'm so absolutely sure that The Ultimate Guide to Buying Apartments with Private Money Course will help your achieve your apartment building investing goals that I'm offering an unconditional, NO-questions-asked 30-day money back guarantee.

If you don't agree this system will help you do your FIRST apartment building deal so you can quit the ratrace in 3-5 years, simply send me an email within 30 days from your purchase and I'll refund you right away!

If you think there's even a "slight chance" that apartment buildings are the way to secure your financial future, you should purchase it today. Because you can try it risk free... and decide if it's right for you over the next 30 days.

My friends think I'm CRAZY for doing this because they say "What if people just take advantage of you?" Someone could buy the course, learn everything in 29 days, and then request a refund. To that, I say, why would I penalize the 99% of people in the world who are good people because of a few bad eggs?

So, that's why I'm offering you this risk-free 30-day guarantee.

If you're not happy, I'm not happy. I hate it when I have to fight for a refund, and I'm not going to give you a hard time if it's not right for you.

As you can see, I’m giving you everything you need to be successful. And also as I’ve shown, your first deal can add $40,000 to your net worth each year (and that’s just with ONE small deal!).

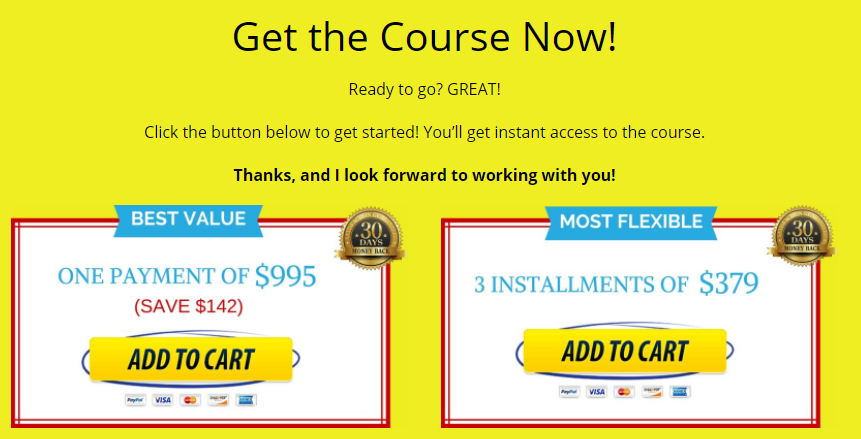

But I’m not going to charge you $4,402 today because I’d like to see more dads and moms replace their incomes to spend more time with their kids, travel, or whatever they want to do. So I’m not going to charge you $4,402 or even half that. In fact, for a limited time, the cost is just 3 monthly payments of $379.

All you have to do is make the first payment today and you’ll unlock complete access to the program and walk through the modules. If you’d like to save 15% you can make just one payment of $995.

The Real Cost of Indecision

Let’s say your Rat Race Number is $5,000 per month.

That means every month you DON’T execute on a reliable real estate strategy, it’s not only costing you $5,000 per month, but you’ll be in the same exact position this time next year as you are right now.

- You’ll have the same J.O.B. next year that you have now;

- You can’t spend the time with your family that you promised your spouse you would;

- You can’t send your kids to the college of their dreams; or

- Your upcoming retirement will look just as uncertain as it does now.

Make a new choice, and Pursue your New Outcome.

Anyone can quit the rat race by using the Ultimate Guide system because it shows you exactly how you can do your FIRST deal. I’ve shown you proof the proof that it works for me, for others, and it will work for you too. You know that with the 30-day no way to lose money back guarantee, you are 100% protected and safe.

You’re at the point of decision. You can either continue down the path of least resistance, the path you have already been traveling, and you can choose the road less traveled. The path of least resistance will probably result in you getting the same outcomes you’ve always received.

But if you want something different to happen, if you want to change the direction of your finances, you’re going to have to do something different.

Tony Robbins said that “In your moments of decision your destiny is shaped”. What will you decide to do right now?

Click the button below, fill out the order form, and you’ll get immediate access to the system. It will contain everything you need to do your first deal.

To your success …

Rome Wells Review about this course

Ok, so you have read the course info... and probably wondering is this course a real deal? Here is what I thought about this course.

Upon reviewing multiple courses on the market that teach folks about commercial real estate investment, I simply wasn't able to find a course better then this one.

You see what Michael touches upon in his course is fundemental factors for how to achieve your financial freedom goal. He uses concepts of well refined and calculated math numbers behind every mental decision that he discusses in the course.

He describes patterns, and gotchas in a way that I simply woouldn't be able to grasp on my own. He is like a guide that shows you everything you need to know about structuring deals and fast forwarding the math in time line periods, which are essential towards your financial freedom goal.

In a way Micahel is very similar to me, except his mindset is really inside the numbers and cashflow generation.. vs anything else... which is of course a great thing... simply because distraction of all things is the enemy #1. He manages to get straight to the point with no fluffy fluff type of explanation.

Some other real estate courses that I managed to explore simply pure water and water into your brain and have way too much fluffy fluff, that makes concept of learning effectiviness obsolete.

What I liked the most about the course is the very simple fact that it focuses on fundemental concepts that makes it easy to undersatnd how the deal would look like after 1 year, 2 year, 3 years.

Now you may say... well Rome Wells, why did you like that?

The reason why I like that is simply because my greatest weakness is understanding the numbers in time line periods. You may say well.. what do you mean?

Aren't you supposadly certified math teacher for the State of Connecticut, Founder of Tutoring Services, LLC, Math Tutor and Engineer and all of the above... then how can you have troulbe understanding numbers in different time lines?

Yes indeed... even though I am certified math teacher for the state of CT and indeed many other things in between...

I can tell you this... that once you have lots of different variables that are lurking around when it comes to investment properties, that even being certified math teacher for the state of CT or a math tutor won't help you.... unless you know the actual patterns behind the numbers in relationship and in context of all the little gotchas... that Michael is clearly describing in the course. (speaking of math here is my profile craeted in my own search engine designed by me)

Now you may say... well Rome Wells, if you are having trouble understanding numbers for how much money property will be in year 1, year 2, minus all the expenses, plus all the appreciation, minus all the headaches... then how on earth can regular folks understand concepts of commercial real estate investment?

Here is how

You see I (Rome Wells) have started journey in exploring commercial real estate literally in January 1 2018 (now it's January 22). It did not take me long to learn concepts of analyzing commercial real estate deals. In literally less than a month... and you can do it too... (speaking of my freedom journey... if interested in seeing me learning REI with you together... and showing you my journey in real time... then feel free to visit my facebook group)

The way to do it is to understand every single process behind purchasing commercial real estate, and while learning concepts behind commercial real estate investment business gradually being experimenting with the syndicated deal analyzer spreadsheet.

The spreadsheet places your mind into the timelines, 1 year, 2 year, 3 year.... to see how much money you can make. Understanding numbers in time lines and knowing what you will do... when you reach particular timeline is critical part of planning...

You see there are many variables and factors that exist out there when it comes to making decision, whether to buy or not to buy property.

You may say well, Rome Wells.. no duhh... I know all that.. why you are putting water in my brain... tell me something I don't know...

Ok, Here is what I must say....

The amount of mistakes you can make when you start out in commercial real estate without first educating your self can put you at risk.. higher risk then what you would have hoped for..

Now.. you may say.. well I know that... but that is still not an excuse for me to pay almost 1k for this course... and get educated tell me something more convincing Rome Wells...

Ok.. Let me give you an example to help you understand how many differect factors involved in commercial real estate....

I am going to try and break it down for you.... Here are the factors that are involved behind purchasing commercial real estate property.

- Property Managers

- Commercial real estate Brokers

- Contractors

- Real Estate Agenets

- Inspectors

- Lawyers

- Accountants

- Underwriters

- Project Managers

What I just described, may seem obvious, but for every one of these factors, that I just mentioned there needs to be an actual strategy behind... pivoting these factors towards your financial freedom goal....

You see the entire business of commercial real estate investment is like a big network... a network of people that can help you reduce risk... but mitigating these risks.. requires you understanding the factors that revolve around multi family commercial real estate.

Everyone of these factors described above requires strategies... and literally diving into the mind set of every one of these factors to help you undersatnd what each factor does, and how is it associated with your financial freedom goal....

What Michael does he touches upon many of these factors in his course, and he breaks it down lots of different details, about each of the factors in one shape or form, to help you reduce risk... when it comes to purchasing your first commercial real estate deal or capturing subsequent deals.

You see I have been in commercial real estate investment for only 22 days, since January 1st 2018... and guess what... the concepts that I discovered, that exist in commercial real estate business are absolutely incredible.

You may say Rome Wells, well why should I listen to this review from you... vs let's say some other successfull commercial real estate investor? After all you don't seem to have lots of experience in discussing any of the topics... in a first place.

Yes indeed, I do not have much experience as of now as I am writing this revie... but what I can tell you is this.... I know how to pivot mindsets of people... and the reason why I am providing this review of Michael's course it to help you pivot your mind in the direction of reality that you should consider pursing....

The reality is simple... if you visualize what you want you will get it... providing that you plan behind the scenes... but to be able to plan behind the scenes you must know numbers and math and details, and timelines and where you will be withing specific timeiline...

To plan and visualize and understand where you will be with your commercial real estate property that you have purchased... in 1 year 2 year 3 years.. you must understand every single detail... about not just the numbers, but the patterns and reasonings for waht makes up these numbers to be true... vs false...

Quick Tip From Rome Wells

Did you know that in many locations commercial real estate agents.. inflate properties by 25%.... in their listing price... on purpose so typical folks who are not knowledgeble enough... end up purchasing money pit vs cash cow?

Do you see how commercial real estate agent is part of the equation? In fact entire concept of commercial real estate investment is like a big equation... Speaking of equations, my company Tutoring Services, LLC provides tutoring for folks in math.. in case if you are interested in learning basic math, consider checking out my Facebook.com/MathTutor

Did you know that broker charges about 3% to 6% of the property value, but is also very helpful in helping you find property?

Did you know that all of these numbers can be minimized, or reduced or completely eradicated depending on how you buy the property?

Did you know that many of these numbers increase your property aquistion costs?

Why is Rome Wells telling you this? I am telling you this is because I do not like middle man... in fact visit my site where I have over 10000 teachers registered in... where I eradicate middle man out of the picture TutoringServices.com Middle man cost people money, and middle man on a big deal will cost you even more money....

Did you know what you find on loopnet already has tons of middle man in between? Deciphering through many of them.. is tricky... trying to make math work is tricky...

Remember idea.. here is not to get your first deal clap your hands and call it a day, but get your first deal under the constraint that it must be the type of deal that can allow you to grow your wealth into the next deal....

That transitional process of diving from one deal to another requries insane level of analysis, so insane that even me... Rome Wells.. had a hard time analyzing.. numbers.....

Mostly the reason why... I had a hard time was because I wasn't able to understand all the possible mistakes, or factors around commercial real estate investment business...

There is just tons and tons and tons of factors guys... when it comes to commercial real estate investment.. factors that you absolutely must understand and model in the timeline in terms of your financial freedom goal.

The entire concept of understanding whether deal is good or bad... is basically entire science....

Factors that were constantly on the back of my mind as I dived into the journey of commercial real estate are vividly describe in my multi family commercial REI facebook group... Read my Factors here... I provide a lot of information that can help you get closer to financial freedom, free of charge in my multi family commercial REI facebook group.